by Terrance Hunsley

Canada’s initial response to the Trump tariffs is encouraging. We are seeing a surge of patriotism among consumers. Federal and provincial governments are cooperating to improve internal markets and propose investments in sustainable infrastructure.

This is also an opportunity to modernize our social infrastructure. Efficiency-enhancing reforms to public health, income security, labour market programs and massive investment in nonprofit housing could mitigate social damage, and strengthen our national solidarity and our economy during hard times.

And we do need reform. A few indicators:

1. FoodBanks Canada reported[1] that in one month last year, there were more than 2 million visits to food banks, a third of the recipients being children, and ten percent being pensioners. With food banks, emergency shelters, drug consumption and begging on the streets, we have developed an extensive poverty industry. Homeless shelters are full and vulnerable people pass out on the streets or in public spaces. Cities are finding their downtowns and public transit facilities degenerating, and inner city slums are exploding.

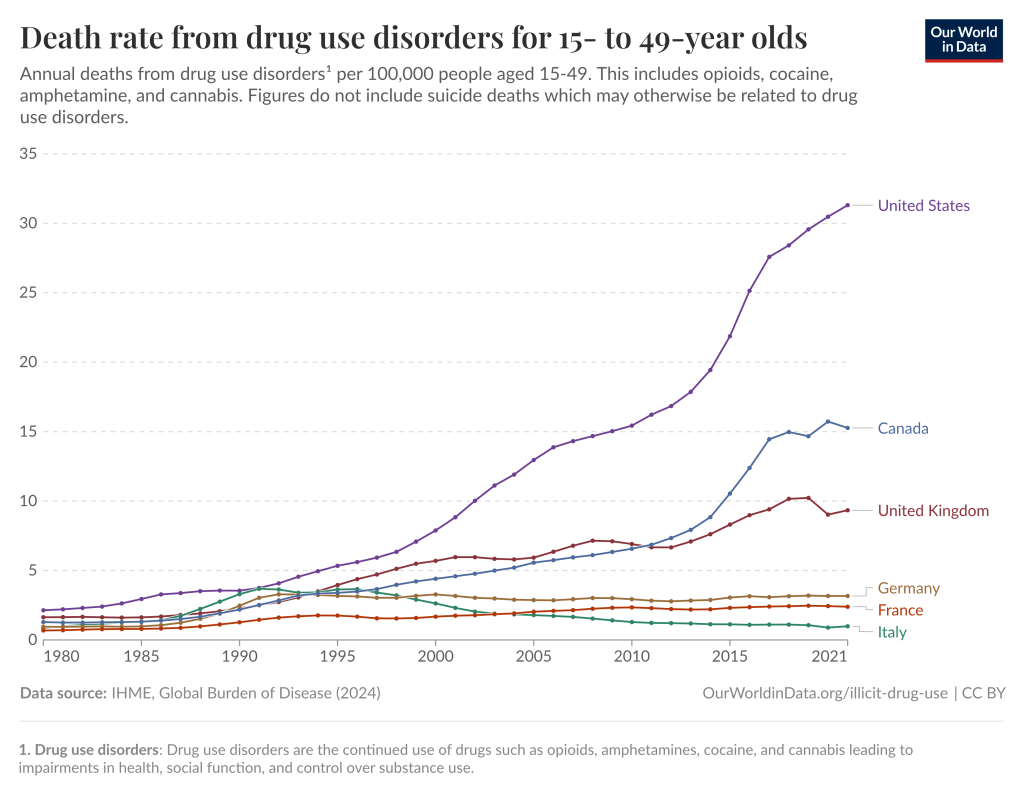

2. We have a closely-related epidemic of drug dependency and overdose death. Better off than the US, but far worse than European countries, we have drug problems that we have not dealt with. (see below).

3. Between 2011 and 2021, the proportion of Canadian households who own their homes, a broadly accepted measure of the well-being of the middle class, decreased from 69% to 66.5%, after decades of steady increase. Canada now ranks well below the OECD average of 71.5%[2]. At the same time, 33% of renter households in Canada spend more than the benchmark of 30% of their income on rent and utilities, while 13% spend more than 50%. Only one of the factors, but highly visible in urban centres, universities recruited hundreds of thousands of foreign students while doing nothing to provide them with housing. They are jammed into inadequate housing that rewards slum landlords with exorbitant revenues and pushes up prices. We turned a silk purse into a sow’s ear.

Hard times call for innovation

There are more issues, but the purpose of this article is to suggest that a nationally-integrated, highly effective social infrastructure would contribute to our national resiliency and economic adaptability.

So…. what if the Bank of Canada were to finance part of a major investment in physical and social infrastructure through a Build Canada Bond issue? Canadians could use their RRSP’s to invest, and pension funds including the CPP, could be encouraged to put their long term investment funds into it. Part of that money could fund a Social Infrastructure Modernization Fund.

The Social Infrastructure Modernization Fund could have a 50/50 cost-sharing provision for working with provinces, municipalities and nonprofit organizations on initiatives such as:

- A massive program of nonprofit housing construction across the country that will:

- Provide next-stage housing for seniors

- Provide rent-to-own housing for modest and lower income households

- Expand our trade skill base and provide tailored work skills development jobs for unskilled workers and people with disabilities or drug dependency.

- Increase student housing, permitting a re-expansion of postsecondary education for foreign students as a healthy economic generator. We should integrate their study with work placements.

- Convert unused government properties to student housing, temporary housing, or care facilities.

2. Construct community health “homes” in these developments and in other public spaces to provide for the kind of universal health care espoused by Jane Philpott, so that people simply go to the centre in their community to receive health and social care[3].

3. Canada needs to replace the myriad of antiquated income – and needs-tested financial assistance programs, with an integrated basic income system. A first step for this is to integrate all financial benefits into a single payer system. The CRA is an obvious candidate for such a role and many millions of dollars could be saved by eliminating duplicative administration. The integration could be tackled in a manner similar to the integration of GST and PST tax systems.

The CRA could provide us with comprehensive individual accounts giving us each year an account of all tax payments and all benefits received, including estimates of the per capita value of collective benefits and services, so we can better appreciate the positive role of government.

4. Following this, since the federal government pays the largest portion of income security costs, all income support should become fully federal, in exchange permitting provinces to ensure universal, inclusive access to health and social services, including wraparound services and secure care, and full postsecondary education, for everyone who needs them.

Let’s take the opportunity to build our national identity around a more resilient national economy. Let’s move away from wasteful federal-provincial fiscal competition in social programs in the same way that we eliminate internal trade barriers.

In our increasingly diverse society, modernizing our social infrastructure can stimulate domestic demand, increase government efficiency, and support national solidarity.

[1]https://foodbankscanada.ca/hungercount/

[2] https://www150.statcan.gc.ca/n1/daily-quotidien/220921/dq220921b-eng.htm

[3] Philpott, J., Health for All: A Doctor’s Prescription for a Healthier Canada, Penguin Random House Books, 2024

👍👍👏!

>

LikeLike

Good ideas, Terry. Thanks. I would add a couple of more. We need equally good statistical information about Canadians 60 to 100 as working age citizens since they are about a fifth of the population. They are tax payers, consumers, investors, grand parents, home owners, donors and volunteers. Secondly, the Finance cabinet committee should have sub-committee on human capital because it is an increasing component of the economy.

LikeLiked by 1 person

specificaly in regards to basic income,

A negative income tax can be regulated easily into the taxcode ny making the Basic Personal Deduction large enough and most importantly ‘refundable’

LikeLike